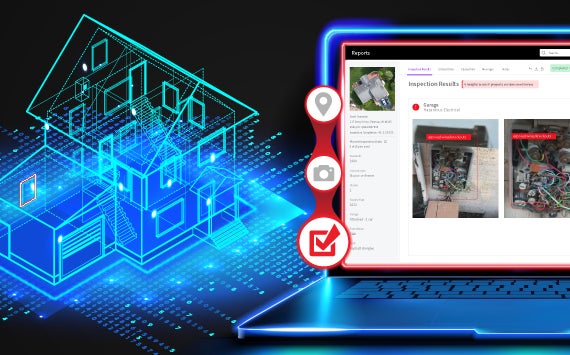

Take property risk assessment to the next level with LexisNexis® Total Property Understanding™

Gain a Total Property Understanding to Improve Home Insurance Risk Assessment

In today’s complex home underwriting environment, carriers need efficient and cost-effective processes that reduce turnaround times and provide a more complete understanding of a property’s risks to help direct resources, provide the right coverage and deliver ongoing value to policyholders. To address these challenges, LexisNexis Risk Solutions offers a complete property risk assessment solution to help home insurance underwriters more easily identify properties with risk or coverage opportunities and survey those priority properties using consumer-friendly, AI-driven property assessment technology that integrates seamlessly into the underwriting workflow. The result: a property underwriting report with ground-level interior and exterior insights, along with aerial imagery and other critical data insights.

Learn more about how LexisNexis® Total Property Understanding™ can improve your underwriting ROI

One Solution. Three powerful capabilities.

Select

Identify and segment properties with the highest probable risk and direct resources to them

Capture

Get hundreds of data insights from the interior, exterior and the sky with our AI-enabled, consumer-led property survey

Act

Configurable underwriting insights that use AI to augment and amplify your underwriting workforce.

Insights and Resources

Awards & Recognition

LexisNexis® Risk Solutions is proud to be recognized for our award-winning solution,

Total Property Understanding™

2023 Luminary Award for Risk Management Innovation